Coverage are automatic when you unlock one sort of profile from the an enthusiastic FDIC-covered lender. When you are in one of the 5.9 million You.S. households instead of a checking account, and you are seeking to open a merchant account, FDIC provides information to aid get you off and running. Although the the new laws usually expand insurance for many trust people, this may eliminate exposure for those who have transferred over $step one.twenty five million for each owner inside faith membership in the you to definitely covered institution. Hence, we strongly recommend which you take the time to remark the faith profile along with your trust and you will estate considered documents to know how you would end up being affected. If you were to think the new laws will get effect your, please call us to discuss your unique problem much more breadth.

Explore IntraFi Network Places

If your boss cannot give a good P60, you can use the fresh HM Cash & Tradition software to find the same information. A great P60 shows simply how much playcasinoonline.ca this article taxation you have paid in the brand new government’s monetary seasons, and this operates away from 6 April to help you 5 April. For the people getting ready to sprinkle of on vacation, i rounded in the analysis wandering charge being recharged by the UK’s biggest cell phone company. It’s not obvious who’ll benefit from the You-turn – all the we know is more pensioners will be qualified and an statement will be produced in the brand new trip.

June Games Meeting Agenda 2025: All of the Showcase And ways to Watch

A flexible Buy away from Withdrawal (NOW) account are a cost savings deposit–maybe not a request deposit account. Unincorporated associations generally covered below this category are churches or other religious communities, area and you can civic groups and you may societal clubs. The fresh FDIC assumes that co-owners’ offers try equivalent except if the brand new deposit account facts county otherwise.

Of many brokerages also offer Cds from additional banking companies nationwide, making it very easy to sit within this FDIC limitations if you are probably getting better rates. Just be conscious that your’re also accountable for making certain that your money are dispersed one of individually chartered banks to maximise your FDIC insurance. Financial downfalls are unrealistic, however they perform takes place. FDIC put insurance covers your own insured places if the financial shuts.

Next, including times might be placed under occasional half dozen-day call-to ensure that DCMWC could have been informed of all the circumstances/commission changes. Prior to January 1, 1957, the benefits of the fresh FECA have been prolonged under certain things so you can reservists of the military and their beneficiaries in which the burns otherwise death of the brand new reservist occurred in distinct responsibility while you are to your productive obligations. Personal Legislation , recognized August 1, 1956, terminated the fresh FECA entitlement to these people productive January step one, 1957. A narrative letter should also be composed on the claimant, having a copy to your DVA, outlining the new costs, write-offs, or form of recuperation out of twin repayments.

Don’t worry, even when, while the next-most-important thing to learn about FDIC publicity is you can be insured for much more, according to where you keep account and just how he is owned. One method to make sure all money is insured is to bequeath it round the multiple establishments. You immediately rating insurance policies to the newest $250,100 restrict when you discover a free account during the a bank one’s FDIC insured. Understand how to insure more $250,000. Banking institutions commonly covered by default.

What it methods to has FDIC insurance rates

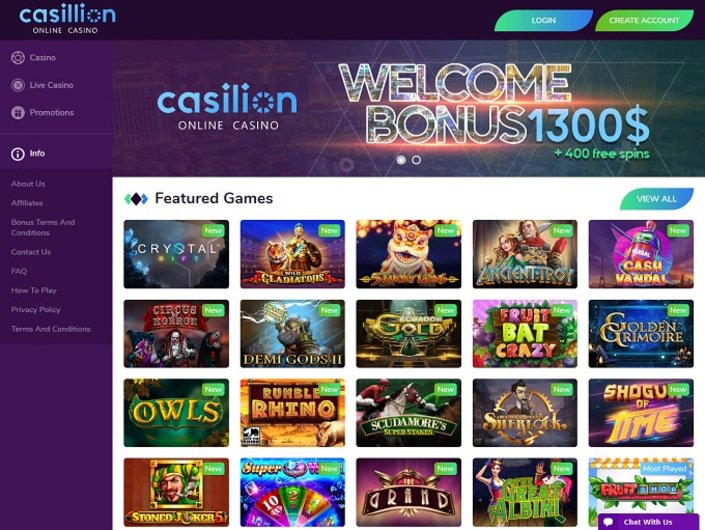

Customers gamble because of the doing offers out of options, in some instances which have a component of skill, including craps, roulette, baccarat, black-jack, and you can electronic poker. Extremely game provides statistically computed possibility you to definitely make sure the household features all the time an advantage along the people. This is expressed more accurately because of the notion of questioned well worth, that is equally negative (regarding the player’s angle). It advantage is named the house boundary. In the games such as poker in which people gamble facing one another, our home takes a percentage called the rake. Gambling enterprises either give out free points otherwise comps so you can gamblers.

- The fresh T&We deposits is insured for the an excellent “pass-through” base on the consumers.

- But not, in practice, money inside the handicap says have been in line with the a week speed.

- Frequently it’s recognized as a lot of months away from spend, and other moments since the a certain number of currency, with respect to the laws governing the new company at issue.

- Of many brokerages also offer Cds from other banks all over the country, therefore it is an easy task to remain within this FDIC restrictions when you are potentially generating best costs.

- The brand new brokered class grounds these types of dumps for higher scrutiny out of authorities throughout the financial analysis episodes and you may reveals the institution to raised FDIC insurance costs.

Phone call Out of Responsibility Seasons cuatro – The The newest Black Ops six Multiplayer Maps, Along with Partner-Favorite Remaster

Inside the very few other instances would it be necessary or desirable to generate a determination of permanent and you can total handicap. Such as a determination confers no extra benefit for the claimant, plus it you could end up forfeiture of almost every other legal rights you to a claimant could possibly get have below almost every other Government regulations. Hence, it certainly is enough to remain costs to own brief full impairment (TTD), even where work in order to reemploy and you will/otherwise rehabilitate the newest claimant failed.

So, people whoever account exceed the brand new limitation during the you to definitely establishment may wish to go a minumum of one account to another associations so you can increase their FDIC exposure. Today, there’s you to definitely faith account category detailed with one another revocable and irrevocable trusts, and you can a believe manager has one $step one.twenty-five million insurance policies restrict for the trusts. All round rule you to a believe account gets $250,100000 of exposure for each and every beneficiary is undamaged. A rely on account that have one to holder (the new trustee) and about three beneficiaries is actually covered to have $750,100000. It is essential for membership owners to see one to their put offer try to your failed bank that is sensed emptiness up on the fresh incapacity of one’s financial. The new getting business has no duty to keep sometimes the brand new failed bank costs otherwise regards to the fresh account arrangement.